India’s smartphone market was flat in 2025 with only a 1% growth year-on-year (YoY) in the number of units shipped. Interestingly, Counterpoint reports that the country continued to shift towards more premium models (defined as ₹30,000+) as the value of smartphones shipped grew by 8% for the year.

Premium phones accounted for 22% of the total number of units shipped. Roughly put, that’s 1 in 5 phones.

This benefited brands focused on pricier models like Apple. While its overall share was pretty low, the iPhone 16 ended the year as the most-shipped individual model for 2025. Also, Apple captured 28% of the value, its highest share yet.

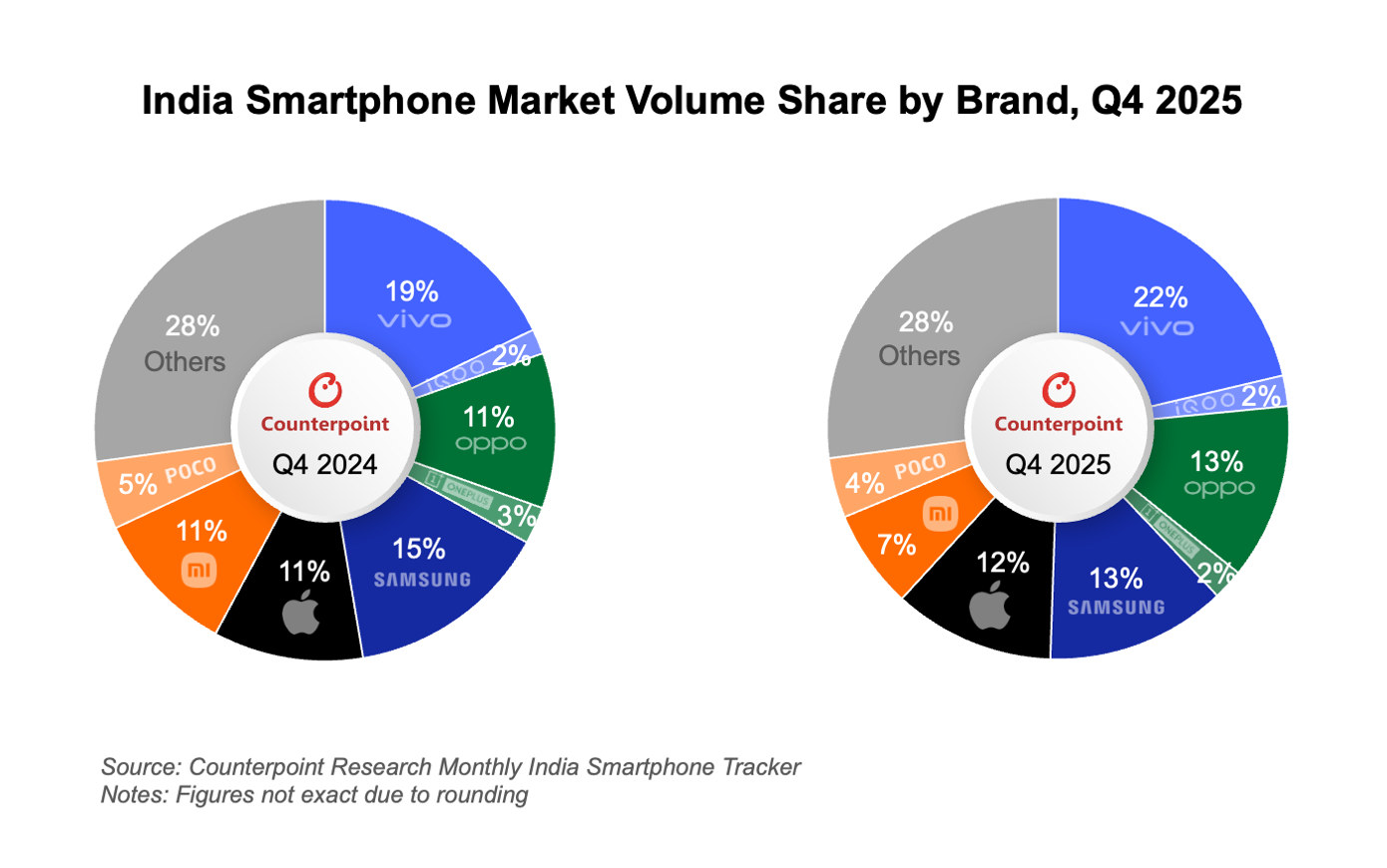

vivo (excluding iQOO) was the top brand in terms of number of phones shipped – it had a 20% share, up from 17% last year. The Y and T series remained staples for the company, but in 2025 the X-series was the standout with a massive 185% growth YoY. The vivo X200 FE got a call-out as one of the reasons behind the X-series’ success.

Samsung remained the #2 brand with the Galaxy S series growing to its highest-ever shipment share inside Samsung’s stable. The Galaxy A, M and F series were still popular too.

Samsung was the undeniable foldables king with an 88% volume share and 28% volume growth YoY. The refreshed designs for the Galaxy Z Fold7 and Z Flip7 proved popular with consumers. Motorola was the #2 foldables maker.

Back to the overall smartphone market. Third place is held by Oppo (excluding OnePlus) with 13%, up slightly from the 12% it held last year. The A and K series pushed the brand up, rather than the more premium Reno and Find X series.

Another important stat shows that 47% of smartphones shipped in India featured a MediaTek chipset, while 29% had a Qualcomm chip.

Counterpoint’s forecast for 2026 projects a small decline as the industry absorbs the impact of rising memory and component costs. The sub-₹15,000 segment will suffer the most.